All eyes are on Spain’s reserves and export numbers.

What’s happening this month?

Historically responsible for nearly 50% of the world’s olive oil supply, Spain remains the country with the most influence on the trade of this food category. Any public data related to crop forecasts, remaining inventory, consumption, and exports released by Spanish authorities have almost immediate repercussions on the market.

The two consecutive negative harvests in Spain, caused by prolonged drought, low water reserves, and periods of global logistic and political instability, have driven the average cost for all Olive Oil grades to unprecedented heights.

The delicate market stability, supported by lower retail consumption data in Europe and January rainfalls in the Iberian region, ended in February after Spain’s official export figures released for January.

Despite the current average trade cost for olive oil grades being as high as two to three times, depending on the grade, compared to historical data, Spain showed strong export figures in January, 24% above the figures for January 2023 and 20% higher than December 2023.

The fact that non-European countries are still driving Olive Oil demand up, combined with the low volumes available for purchase in the market, raises concerns about the availability necessary to meet the global demand in 2024, and the Spanish market responded immediately with a cost increase.

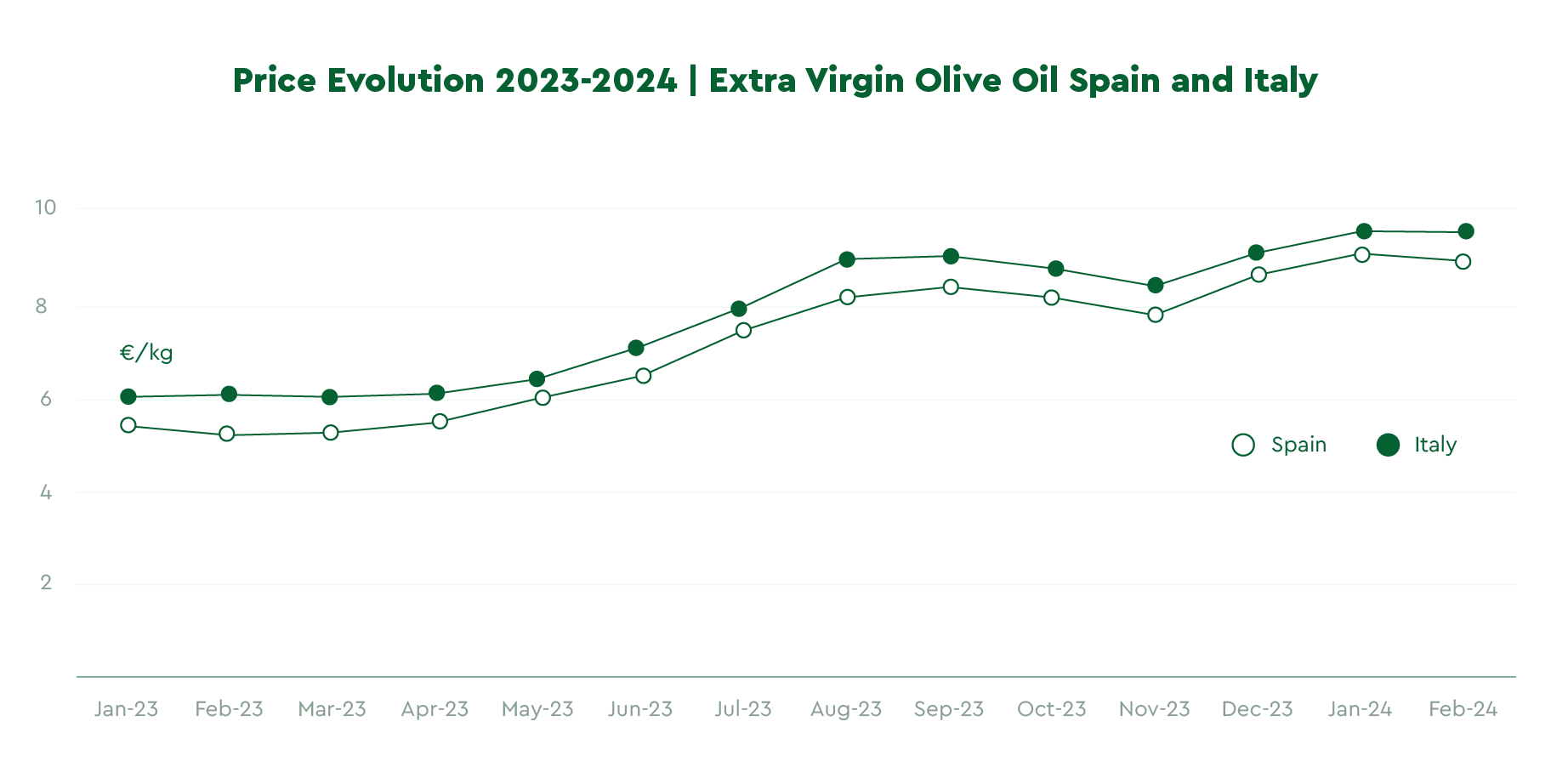

At the time we prepared this document, the leading Olive Oil trade platforms reported substantially high prices for Extra Virgin Olive Oil:

Italy: 9.54 Eu/Kg: + 56% vs the same period in 2023

Spain: 8.92 Eu/KG: + 68% vs the same period in 2023

Greece: 9.15 Eur/Kg: + 82 % vs. the same period in 2023

Tunisia: 8.45 Eur/ Kg: + 64.9% vs the same period in 2023

Pooled and Ismea, from Spain and Italy, allow us to track macro trends. Prices on the actual trade market for pesticide-free grades necessary for export, organic, and other specific quality grades can be significantly higher.

Sources: Poolred, Ismeamercati

Sources: Poolred, Ismeamercati

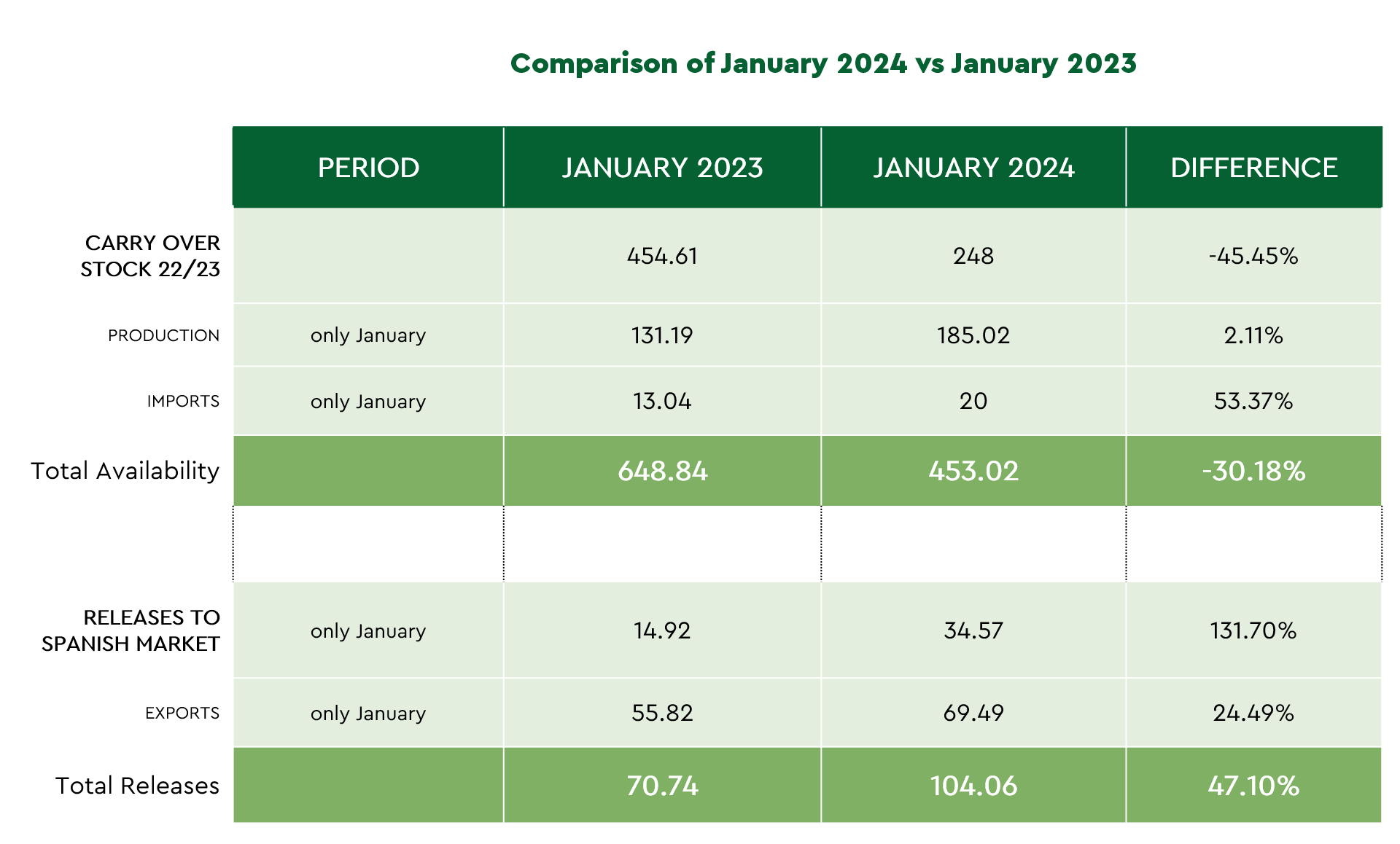

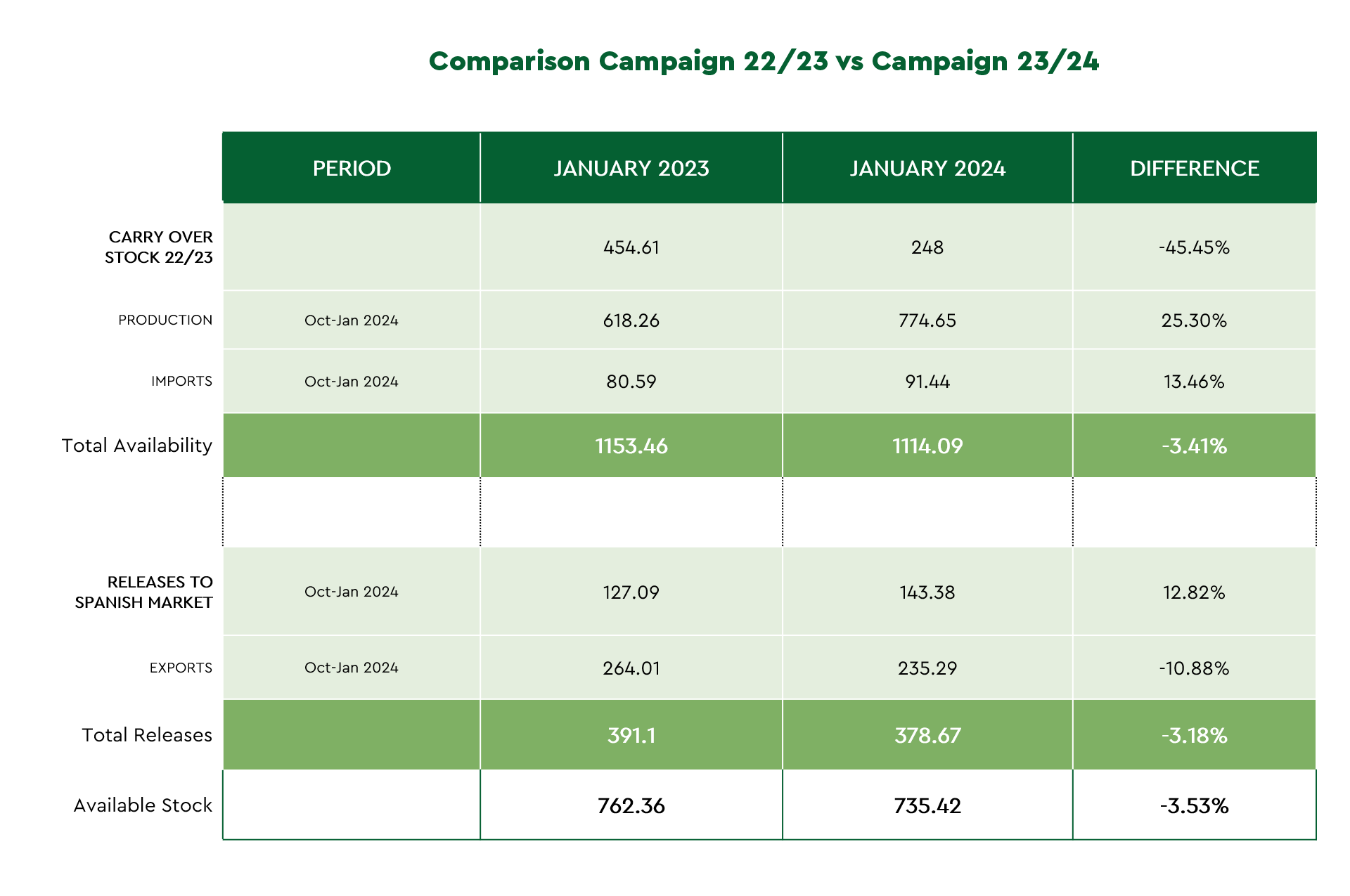

Spain’s Export and Reserves in January

Spanish cooperatives and private traders reportedly released over 104,600 Tons of olive oil into the market in January through export and national sales. National authorities have officially confirmed this cumulative value, which is 47.19% higher than the January 2023 figures and 14% higher than the average from October to January 2024: circa 91,000 Tons.

The jump in sales surprised many traders and experts, especially considering that the average price for Spanish Evoo in January 2024 was 70% higher than in January 2023. With other reports observing a generalized decline in consumption in Europe, to fully understand where this increase in demand comes from, we need to isolate the export data, which is the main driver for this up-trend.

Export number January 2024: 69,490 Tons

Export number January 2023: 55,820 Tons

Export average number campaign 2023/24 (October- January 2024): 55,270 Tons

Export average number campaign 2022/ 2023 (October- September 2024): 59,600 Tons

With low inventory, a well below-average crop from Spain, and no significant decline in global demand, retailers and traders start to worry about having enough products (of the right quality) to fulfill the needs of their clients.

Despite the slightly better results from the latest harvest in Spain, the Spanish Olive Oil reserves remain extremely low.

In January, the magazine Olive Oil Times projected the latest Spanish crop to deliver between 680,000 to 700,000 Tons of new olive oil, a value 25.30% higher than January 2023. Today, the actual production numbers seem closer to 774,000 Tons, but still almost 50% below Spain’s full potential.

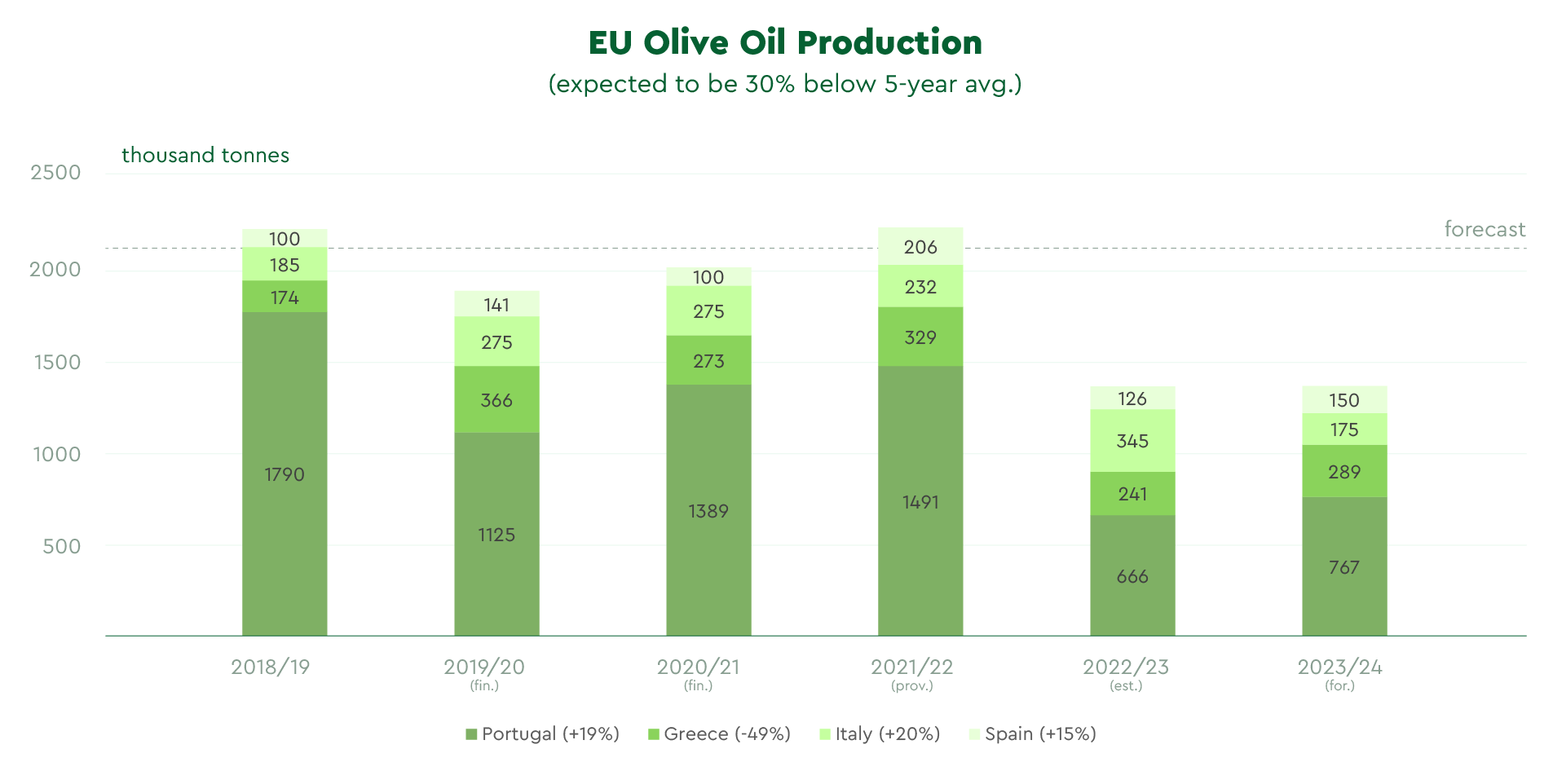

European Commission Report: A global outlook for the current crop year

The European Commission published its annual olive oil and olives report beginning of February, providing a comprehensive outlook for the current harvest year from one of the regions responsible for most of the world’s production for this category. According to their data, world olive oil production from 2023/24 will reach 2,396,000 Tons.

Source: International Olive Council, Member States Declaration. Note: Excl. Pomace Oil

This number, if confirmed, would result in a decrease of -6% compared to last year’s and -23% compared to the average over the previous five years. The total output from European countries remains well below the historical data, aligning with last year’s results.

Source: International Olive Council, Member States Declaration. Note: Excl. Pomace Oil

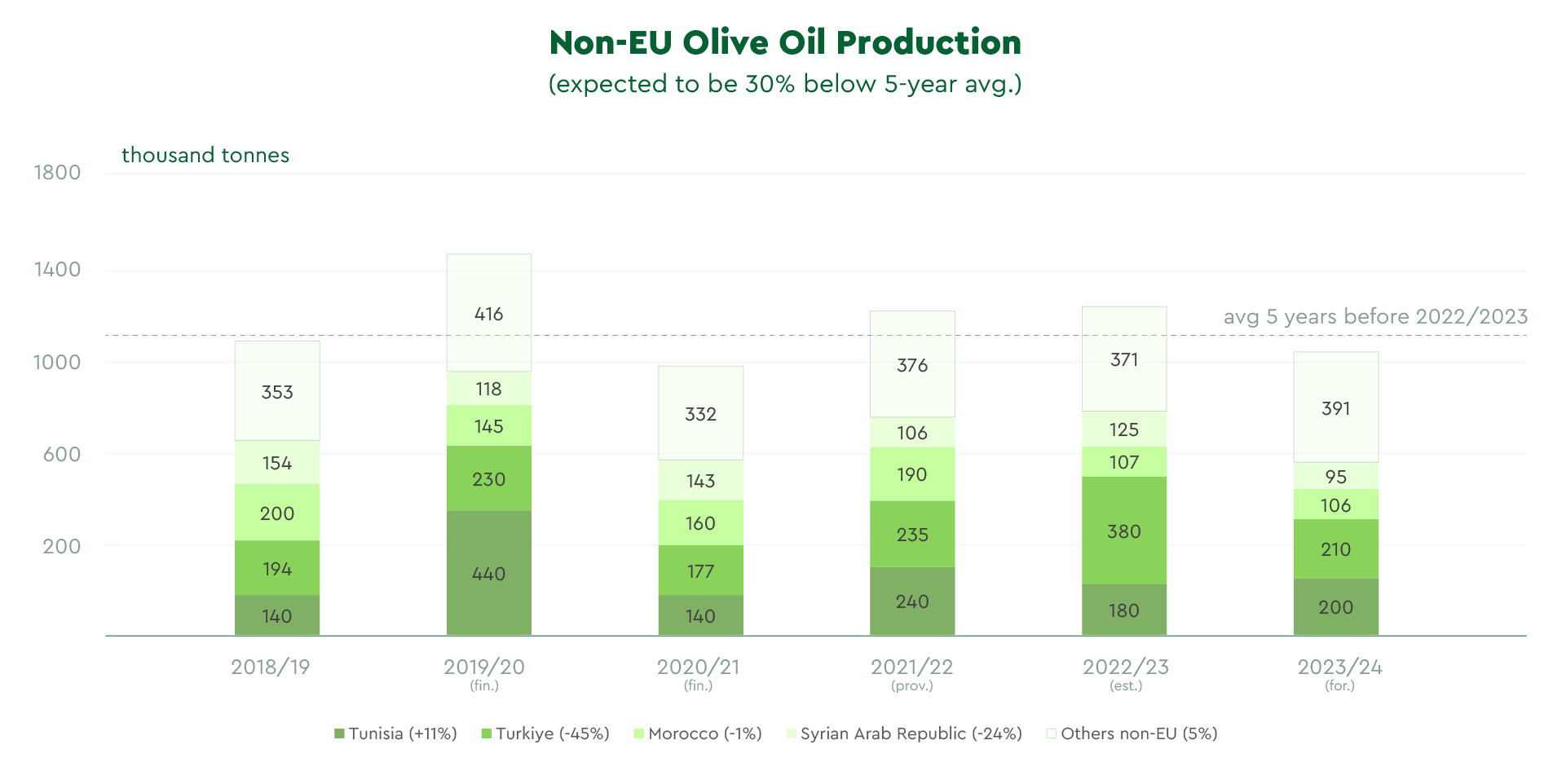

The EC also expects a decline of production of 14% from the non-European countries. The most relevant contributors to the global output outside the European Union are Turkey, Morocco, Tunisia, and Syria, all concentrated in the Mediterranean area. Among the four, Tunisia remains the region with a distinctive vocation for international export, especially of certified Organic Evoo. In contrast, the others allocate most of their production to meet local demand.

Final Thoughts

The January figures leave us with two core takeaways.

As we approach the end of the harvest season in the Mediterranean area, responsible collectively for over 80% of the world’s production, it is clear that we are facing another complicated year. Spain’s volumes are projected to be above the initially pessimistic forecast but still well below the average yearly volumes, resulting most likely in general market tension and sustained prices in the short and medium term.

In countries with historically high per-capita consumption, such as Spain and Italy, retailers are experiencing a drop in sales for Extra Virgin Olive Oil caused by the exceptionally high prices on the shelf and the cultural expectation for low cost for this everyday ingredient.

Nevertheless, in non-EU countries, where EVOO is often the condiment of choice for a segment of the populations with higher purchasing power, sales seem to hold better, driving demand for export from the Mediterranean and raising concerns about the global availability of quality olive oil for the whole 2024. The next few weeks will be decisive in understanding how the higher prices will impact non-EU retail trends as old stock rotates and new price tags arrive on the shelf with the latest inventory.

For the time being, we suggest our partners and friends in retail to avoid running price promotions while, at the same time, maintaining a healthy inventory level and volume coverage, waiting for the potential opportunity of a drop in cost at the source, as we collectively wait for some good news from the Mediterranean, and Spain in particular.

Spring will bring new information when experts start sharing their first impressions about the next campaign’s production capacity based on the olive tree’s condition.

Back to Learn & Discover Back to Market Reports