Stability in Spain, political challenges in Turkey and USA, struggle in Morocco and Italy.

What’s happening this month?

Even though average prices in Spain have slightly further declined since our last report on January 22nd (4.50 Eu/Kg compared to 4.16 Eu/Kg as of February 18th on Poolred), the core market activity appears to have decelerated, following the robust January sales figures announced by the Spanish government on February 12th. These official figures from the most significant global producer of Olive Oil and Extra Virgin Olive Oil once again highlighted the strengthening of international and domestic demand for the category.

Since the data was released in Spain, our purchasing department has observed a more stable pricing environment and consistent trading activity overall. Current market prices for high-quality Spanish conventional EVOO range from 4.60 to 4.95 Eu/Kg, while Spanish organic EVOO trades between 5.70 and 6.00 Eu/Kg.

In Italy, the situation remains unchanged. Due to the low volumes from the current harvest and the consistent demand, prices remain elevated, with no expectations of reduction in the near future. Traders value high-quality extra virgin olive oil at approximately 9.30 Eu/Kg for conventional and 10.30 Eu/Kg for certified organic.

Tunisian origin, in contrast, has seen a notable value reduction from last year, with 3.85 Eu/Kg average evaluation for conventional and 4.10 Eu/Kg for organic. The factors influencing this trend are most likely linked to the new value assessment in Spain (contributing to almost half of the global supply) and the overall return of historical availability for olive oil this year.

Looking ahead, Morocco, Turkey, and the USA are the producing and import regions that could disrupt this phase of relative market stability. But first, let’s examine Spain’s balance sheet.

Spain’s January figures

As of January 2025, olive oil reserves are improving, returning to historical volumes held by bottling industries, securing their positions for better stock management in the coming months. Spain reported a total olive oil production of 344,530 Tons in January, bringing cumulative production to 1,234,568 Tons.

Sales for the same month amounted to 116,104 Tons, excluding imports estimated at 15,000 to 20,000 additional Tons. While the last figure is higher than anticipated, it aligns with the increased demand from Italy, home to some of the largest global brands and international trading players, reacting to a scarce national production and working to replenish house stock levels for 2025 after two consecutive bad harvests in Spain and consequent scarce global availability.

Another contributing factor to the Spanish balance sheet is the increased activity from large local and international retailers, which are reacting to a strengthening demand, driven by newly attractive prices and widespread promotions activated in recent weeks, deployed to regain market shares lost to seed oils after a year of historically high shelf prices for Olive Oil and Extra Virgin Olive Oil.

Key data for January in Spain:

- – January sales of 116,104 Tons (excluding imports)

- – Monthly production of 344,530 Tons, cumulative production of 1,234,568 Tons

- – Total existing stock on January 31st:

- – Cooperatives: (865,176 Tons)

- – Packers: (176,295 Tons)

- – PCO (public storage) (14,969 Tons)

The industry sentiment is generally positive in Spain, with stakeholders expressing satisfaction thanks to the strong demand for olive oil and optimism for further growth in the coming months.

The Threat of U.S. Tariffs on Mediterranean Producers

Traditional media and social media platforms are flooded by the substantial flow of announcements from the North American government, and organizations from the private and public sectors are weighing in on the subject, analyzing data, numbers, and possible future scenarios. While the U.S. government has not yet imposed tariffs on agricultural imports, the European Union and its 27 state members are preparing for the possibility of such measures.

On February 14th, Spanish Cooperativa Agroalimentaria issued a public letter expressing concerns that reflect the views of the olive oil sector at large. Tariffs on imported agricultural products will increase the cost of groceries in the United States, reducing demand for Olive oil and Extra Virgin Olive Oil.

The tariff case for Olive Oil and Extra Virgin Olive Oil is peculiar and does require a specific focus. The U.S. is the world’s second-largest olive oil consumer, with an average annual consumption of 390,000 Tons. Yet, the domestic production, concentrated mainly in California, accounts for just 3.84% of this demand, with smaller outputs in Texas, Georgia, Florida, Arizona, and Hawaii.

Even by investing heavily in new Olive groves in the U.S., it could take decades for national production to come close to meeting the growing demand of American food businesses, grocers, and families for olive oil, which is currently imported primarily from the Mediterranean, responsible for approximately 80% of the global production.

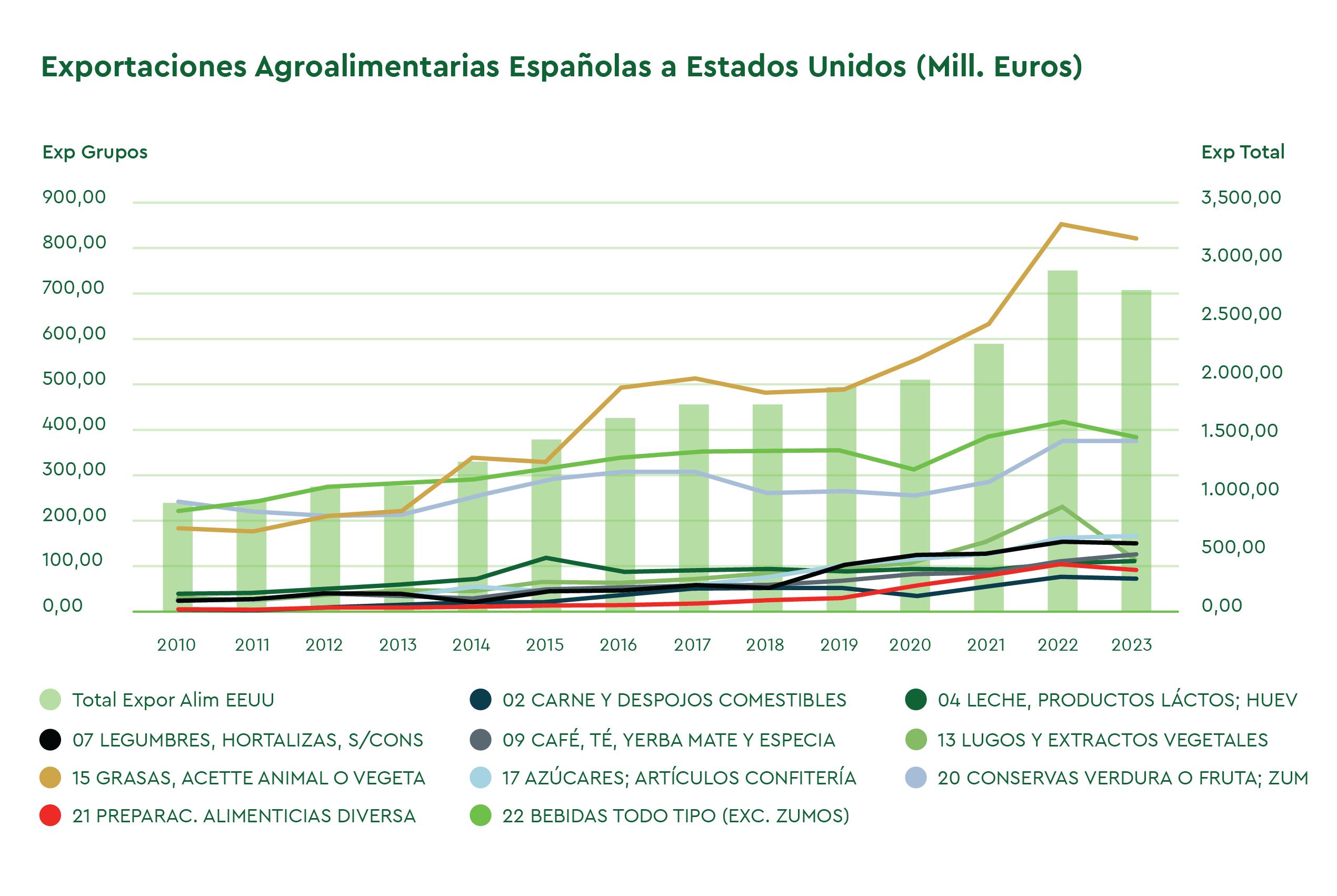

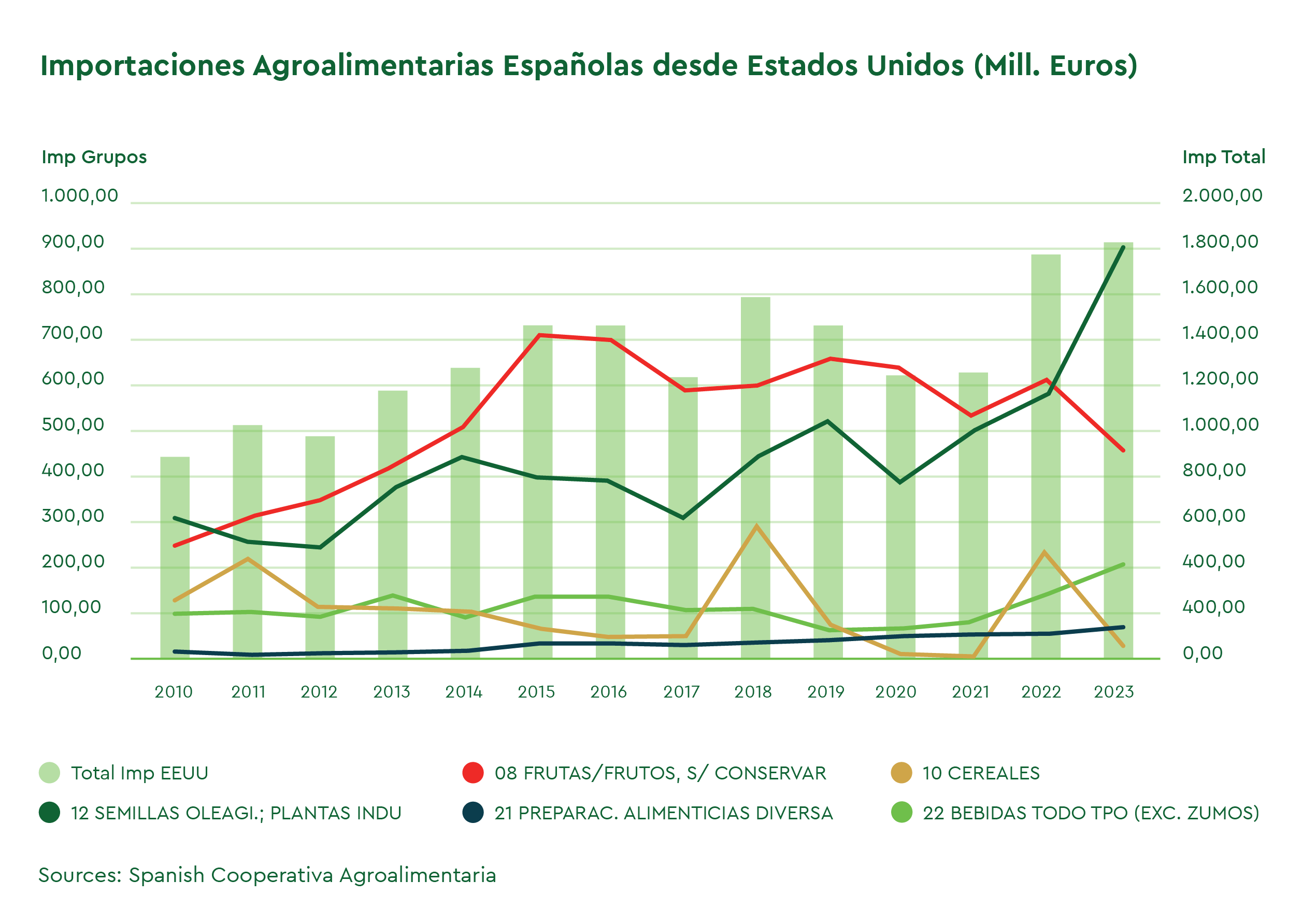

Reviewing the current trade relationship between Spain and the U.S., and excluding the value of services, data reveals that the agri-food sector is where Spain maintains a trade value surplus towards the U.S., mainly due to olive oil exports.

On October 18, 2019, the White House imposed a 25% tariff on bottled Spanish olive oil. The tariff lasted until March 5, 2021, when it was suspended and lifted indefinitely in June 2021. During this period, Spanish EVOO exports of bottled oil to the U.S. dropped by over 80% in the first months after the tariff imposition, leading U.S. buyers to shift toward suppliers like Tunisia, Turkey, and Portugal. Spanish producers shipping packaged products from Europe faced significant financial losses, while bulk oil exports were less affected, favoring players with bottling plants and direct operations in the U.S. territory.

At this stage, the potential impact of future U.S. tariffs on the olive oil industry at large or focusing on Spain remains uncertain. However, new restrictions will directly impact U.S. retailers and all major Mediterranean producers.

New price strategy from Turkey

Turkey expects a record harvest of 450,000 Tons for the 2024/2025 crop year and is on the trajectory to become a key global olive oil market player. A report published last week by the Spanish trade magazine Olimerca covered the recent political decision by the Turkish government to suspend olive oil exports temporarily, as done in the past.

The magazine’s analysis is that while this recent measure had a minimal impact, the prompt release of these volumes by Ankara could create strong market waves. The quick shifting of the Turkish government’s export policies and announcements could also create uncertainty for potential international stakeholders looking at the country as a long-term, reliable business partner.

Morocco’s Third Bad Crop Year

While non-EU Olive Oil players like Turkey and Tunisia benefit from stable and growing production levels, Morocco faces another challenging year. According to an article by the Olive Oil Times, Morocco is confronting its third consecutive year of declining olive harvest due to prolonged drought and extreme heat, damaging trees and fruits. In 2024/25, production is forecast to drop to 90,000 Tons—well below the five-year average of 141,600 Tons.

Olive Oil prices are rising locally, along with concerns about domestic shortages. In response, the Moroccan government has suspended import duties and is moving to import 30,000 Tons of olive oil from other countries to meet the nation’s estimated consumption of 140,000 Tons this year (per IOC data).

Final Thoughts

The global olive oil scenario remains complex, with contrasting forces across key producing regions and destination markets.

Spain shows price stability following strong January sales, while Italy continues to deal with high prices due to poor harvest expectations. Potential disruptions might arise from Morocco‘s reduced output, Turkey‘s export approach, and possible U.S. import tariffs. Each of these factors could significantly impact the market in the coming months.

Our sourcing and sales teams recommend that our business partners take a cautious approach when covering substantial volume needs or closing long-term contracts. Keeping a broad global view of the market while understanding the peculiarities of each country of origin will provide strategic advantages to national and international players.

Investing in strong trade relations and building logistic infrastructures to prepare for swift changes in market and political conditions will help producers and retailers navigate 2025 in the best possible conditions.

Our group of international experts and global infrastructure are ready to support your private label portfolio expansion and strategies. Please contact us with any questions about the olive oil market, sourcing, or packaging trends.

Olimerca,

Mercacei,

Olive Oil Times,

Cooperativas Agro Alimentarias España,

Poolred,

Ismea Mercati,

International Council

Back to Learn & Discover Back to Market Reports