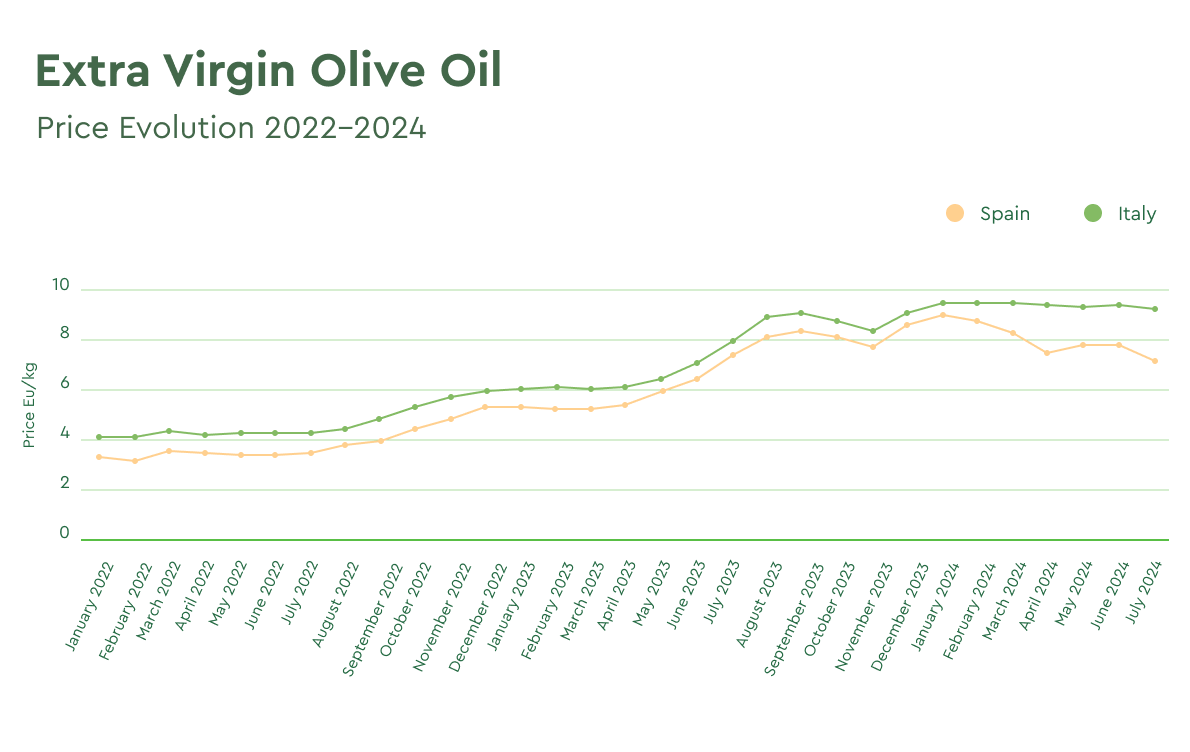

Prices are trending down in Spain, Greece, and Tunisia. Italy remains the exception.

What’s happening this month?

While olive oil and extra virgin olive oil (EVOO) prices in Spain, the largest world producer, remained relatively stable through June, July showed a clear downward trend despite solid consumption and export figures, combined with a critically low stock situation.

Poolred, the primary platform for monitoring olive oil exchanges in Spain, recorded EVOO evaluation at around 7 Eu/Kg, a 12% drop from the previous month and a 23% decrease from the January peak of 9 Eu/Kg.

The Italian ISMEA agency reports declining trade prices also for Tunisia and Greece since mid-June:

Tunisia: 7.63 Eu/Kg (down from 7.83 Eu/Kg in June 2024)

Greece: 8.08 Eu/Kg (down from 8.30 Eu/Kg in June 2024)

In contrast, the Italian EVOO market has remained mostly stable. The Italian ISMEA agency reported an EVOO valuation of 9.30 Eu/Kg, just 0.3% lower than the previous week and only about 2% below the January 2024 peak.

It’s important to note that trade platforms provide general trends and do not account for variations in quality and grade.

High-quality, pesticide-free extra virgin olive oil suitable for international export remains in demand at 8 Eu/Kg for Spanish conventional grade and about 8.60 Eu/Kg for organic. For Italian EVOO, the ISMEA evaluation aligns with market rates for conventional, with a 0.30 Eu/Kg premium for organic.

Sources: Poolred, Ismeamercati

Spanish and Italian inventory

Spain anticipates an increased domestic demand for olive oil and extra virgin olive oil in the coming months due to a VAT reduction implemented on July 1st by the national government. The move was designed to boost local consumption and support the population, which has been hit by inflation and rising living costs.

In June, Spain released around 76,500 Tons of olive oil (excluding imports from other countries). Although slightly below May’s figures, June was still a strong sales month. Spain’s stocks have fallen to approximately 415,000 Tons, around 10% less than last year. At the end of the last campaign, Spain had only 248,100 Tons left.

Of the current 415,000 Tons, 251,512 Tons are held by oil mills, and 162,180 Tons are in the hands of industrial packers.

Italian-based bottling plants, brands, and traders are expected to make substantial purchases from Spain in the coming months as well. According to Olimerca, a Spanish trade magazine, Italian reserves may be short of the 150,000 Tons of EVOO needed to cover its national and global demand.

Italy currently holds 130,478 Tons of extra virgin olive oil, with 82,674 Tons being Italian EVOO, a 22% reduction compared to last year (June 30, 2023: 166,113 Tons).

Spanish producers are in the position to help, covering approximately 70% of these missing volumes before the new harvest begins in the Mediterranean. The rest could be arriving from Tunisia and Turkey, where export bans have been partially lifted.

According to Olimerca, Tunisia, in particular, is confirmed to be a major global player in this category thanks to its key role during the two consecutive years of scarcity caused by Spain’s drought, recording historic export numbers in the 2023/2024 campaign.

Final thoughts

As the new harvest approaches, demand for Spanish olive oils from local and international markets will remain strong. While stocks are critical, Spain and the world are unlikely to run out of olive oil entirely, as feared not long ago.

Olive oil cooperatives and agri-food companies predict ending the campaign with around 180,000 Tons in reserves available, as the sum of all quality grades. Although this would be the lowest stock in history, and the quality of the extra virgin olive oil reserves could be below average, it will be manageable.

From today’s perspective, there are few arguments in support of a new spike in prices until the new harvest. In a declining market, traders’ main concern is to close a good deal today rather than sell at a lower price tomorrow. Also, oil mills and packers in Spain will soon need to make room for the new harvest, releasing volumes to the market and contributing to the downtrend.

The solid demand for Italian-origin EVOO, globally appreciated for its reputation of quality, sold as a single origin or utilized to add flavor profile intensity to blends, has allowed the Italian market to maintain its price dynamic so far.

The price gap between Italian and other origins is widening again, with a 2 Eu/Kg differential with Spain after two years of unprecedented narrowing. It remains to be seen if Italy will follow global pricing trends as the new harvest approaches.

As we navigate these new market dynamics and manage inventories carefully, we advise our friends and business partners to monitor extra virgin olive oil organoleptic and quality parameters very closely, especially when aggressive price offers are involved.

Our team of sourcing and retail specialists remains at your disposal for any questions or doubts you might have.

The following market report will be published in September, respecting the European holiday break.

Until then, we wish everyone a pleasant and relaxing summer.

Back to Learn & Discover Back to Market Reports