Low inventory and high expectations

What’s happening this month?

Following the robust sales figures coming from Spain in June, with approximately 100,000 Tons of olive oil sold, the market remains sustained. The consistent high demand for olive oil, despite high retail prices, and the increasingly scarce stocks in major producing countries like Spain and Italy, continue to create tensions.

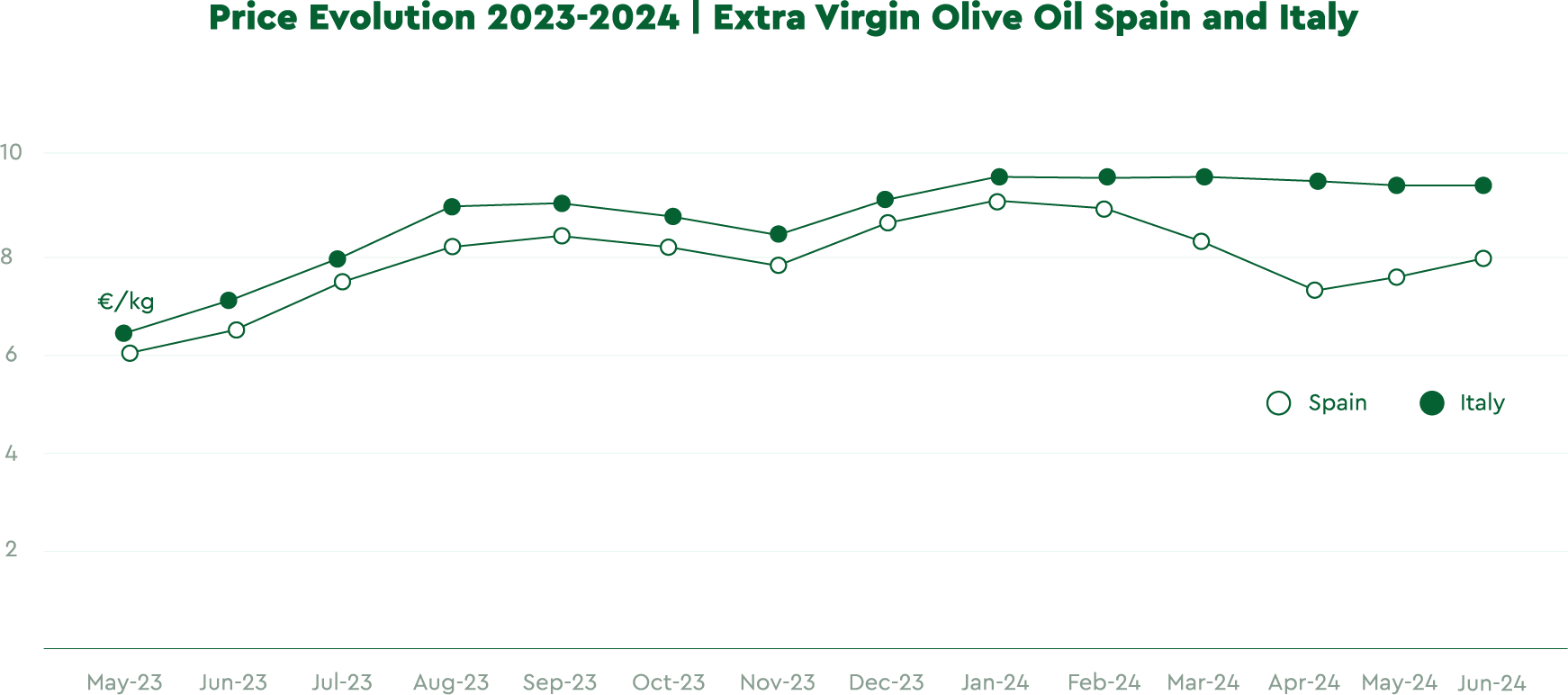

According to Poolred, average trade prices of Spanish EVOO have increased to around 8 Eu/ Kg, a slight rise of approximately 2% compared to May 2024. However, ISMEA reports stable prices for Greece, Tunisia, and Italy.

The current prices are as follows:

Spain: 7.924 Eu/ Kg (↓ 0.05% from the previous week, Poolred)

Italy: 9.44 Eu/ Kg (unchanged, ISMEA)

Greece: 8.30 Eu/ Kg (unchanged, ISMEA)

Tunisia: 7.73 Eu/ Kg (unchanged, ISMEA)

It’s important to note that ISMEA and Poolred track macro trends and may not account for variations in quality and grade. For high-quality extra virgin olive oil, especially those suitable for export with low pesticide residues, our sourcing team reports prices between 0.20-0.30 Eu/Kg above these average prices.

Sources: Poolred, Ismeamercati

Spanish and Italian inventory

As of May 31, 2024, Spain’s olive oil reserves stood at 492,000 Tons -a 7% decrease from the previous year and 46% below the five-year average of 914,200 Tons, and distributed as follows:

Cooperatives: 319,910 Tons

Industrial Packers: 170,710 Tons

Individual Owners: 1,662 Tons

According to Cooperativas Agro-alimentarias de España an organization that represents the agri-food cooperative movement of the 170,710 Tons held by packers only 53% is extra virgin olive oil (91,877 Tons), and 17% of it has already been packaged (29,887 Tons).

As the agriculture sector in Spain prepares for the upcoming crop at the end of the year, the association predicts that there will be a carryover of only 200,000 Tons from one harvest to the next. Considering the historical outflows and inflows from June to September, it is likely that the stock levels will be even lower by the end of September.

Italy’s stock situation is similar to Spain. As of May 31, 2024, Italy held 203,186 Tons of olive oil, with extra virgin olive oil comprising 72.8% (131,278 Tons). Approximately 90% of this stock is stored in bulk (182,850 Tons), which is about 20% less than the previous year.

According to the magazine Olimerca, monthly consumption in Italy is around 50,000-60,000 Tons, suggesting a total consumption of around 200,000 Tons by September. Therefore, Italy will likely need to import additional supplies from neighboring countries to avoid depleting their stocks before the new harvest.

Harvest Outlook – First impressions from our sourcing team in Andalucia, Spain

Our sourcing team recently visited Andalusia, the largest olive-growing region in Spain and the world, and a crucial market player. They reported positive impressions of the abundant olive fruits on the branches.

Thanks to the moderate rainfall in recent months and generally favorable and stable weather conditions, the olive trees appear healthy and have recovered from the two previous consecutive years of historic drought and heat waves. Andalusia’s water reservoirs are at 41% capacity, a significant improvement from last year, though still well below the ten-year average.

According to our team’s conversations with local experts and farmers, Spain is projected to achieve a harvest of 1,700,000 Tons, a substantial increase from the previous year’s production of 850,479 Tons. The largest contributions are expected from Andalusia, with significant outputs from the Jaen and Cordoba areas.

Final thoughts

The harvest forecasts for the next global production is promising, with projected volumes exceeding 3 million Tons, which would be more than 1 million Tons above previous year results.

Despite this, because of the low inventory available today, the trade market is expected to remain substantially high and stable until the new harvest starts to replenish the tanks of cooperatives and olive mills in the Mediterranean between Q4 2024 and Q1 2025.

Turkish government export restrictions have been relaxed, allowing for an additional 50,000 Tons to be exported, which may help accelerate the downtrend for average trading prices of some olive oil categories.

We recommend our retailers and friends to monitor consistently existing levels of in-house products to arrive towards the end of the year with a balanced inventory evaluation once the market prices relax, and to keep close communication with your sourcing partners.

As summer approaches our team of experts will intensify the visits on the ground and report back on developments in other key producing Mediterranean countries, such as Tunisia and Greece.

Please reach out to us for any question or curiosity you may have on the Olive Oil market, prices and product trends.

Back to Learn & Discover Back to Market Reports