Rain brings optimism in the Mediterranean

What’s happening this month?

Recent rainfall in the Mediterranean region, particularly in the Iberian Peninsula, is bringing some much-needed relief from the devastating drought that has caused a sharp decline in Spanish olive oil production over the past two years and a diffused cost increase in all producing countries.

Although water reserves remain substantially low, farmers, cooperatives, and producers are beginning to share optimism about the upcoming olive harvest and oil production.

The prospect of a favorable harvest at the end of 2024 in Spain, the largest producer in the world, combined with a general decline in Extra Virgin Olive Oil consumption in the Mediterranean area caused by the high retail prices, is affecting global trade prices.

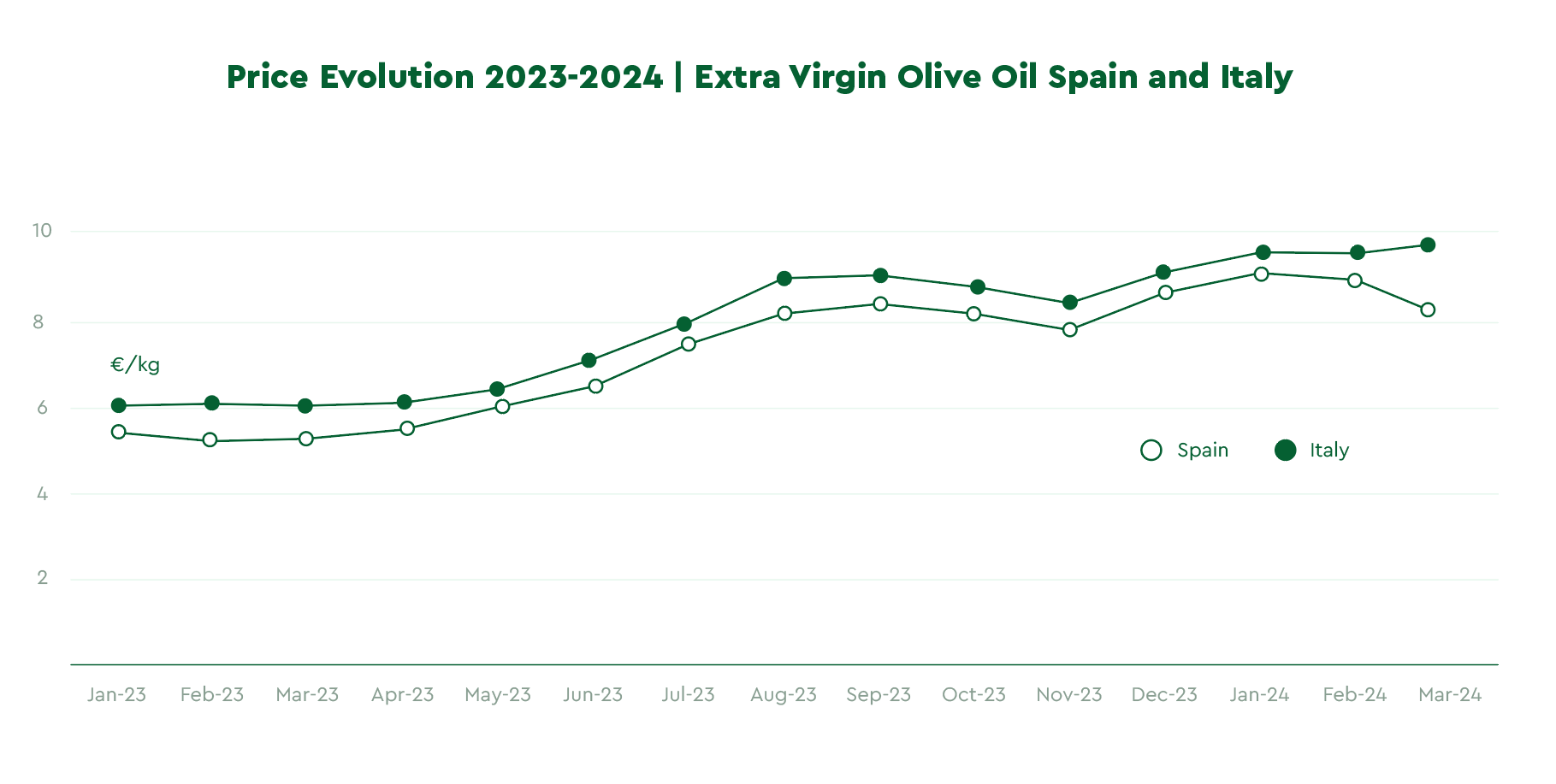

According to the latest reports from leading trade platforms Poolred and Ismea, in March, the cost for bulk purchases decreased by a few percentage points compared to the previous month. However, it remains well above the 2023 averages:

Italy: 9.55 Eu/Kg → 0% versus last month, + 57.6 % versus price same period 2023

Spain: 8.26 Eu/Kg → -6.08 % versus last month, + 55.8 % versus price same period 2023

Greece: 8.94 Eu/Kg → -2% versus last month, + 77.9 % versus price same period 2023

Tunisia: 8.35 Eu/Kg → -1% versus last month, + 61.4 % versus price same period 2023

The average market cost of Extra Virgin Olive Oil and other oil grades at origin in Spain and other producing countries show signs of stability for the first time and even a negative trend after several months of volatility and constant growth.

It may take additional time to determine whether the macro-downtrend will escalate and impact all product categories and quality grades in the following months.

Due to restricted supply and significant demand, particularly from foreign markets, the cost of Extra Virgin Olive Oils that are free of pesticides, high in quality, traceable, and certified remains significantly higher than the average trading value.

Spain and Tunisia are, in particular, reporting substantial export numbers.

Tunisian olive oil, typically priced slightly below Spanish origins value and quickly becoming a leading player in the Mediterranean for certified organic EVOO, continues to experience a rise in demand and exports. According to Olimerca, February exports increased by an impressive 99.4% compared to February 2023.

Spain’s March Balance

According to AICA, Spain produced an additional 53,445 Tons of olive oil in February, approaching the end of the harvest season, and bringing the accumulated production figure to 829,516 Tons, which is 26% higher than the previous year’s figure. Spain currently has a stock of 712,570 Tons, which is 23,050 Tons less than in January and about 27,000 Tons less than in February 2023.

In February, approximately 75,900 Tons of olive oil were released to the market in Spain, including both national sales and exports, imports excluded. This figure is about 9% lower than the previous month’s number, but still above the average for this campaign (which is 72,000 Tons, without including imports).

Spanish experts and institutions perceived these numbers as a clear indication of the preference for Extra Virgin Olive Oil in international retail markets, despite the higher prices.

Cristóbal Cano, the general secretary of UPA Andalusia and head of the UPA Olive and Oil Sector, evaluated the data as excellent“ (…) The data published by the AICA are magnificent, because they confirm that the current price situation has not influenced at all the decision of consumers to remain faithful to the healthiest fat there is. Society wants olive oil, it is betting on its acquisition and that is the news, far from what some interested doomsayers predicted that the price would mean a decrease in consumption”

Prices and Purchasing Behaviour

The steep price hikes of the past year have caused a drop in consumption in Mediterranean countries, including Italy, a leader in per capita consumption of high-quality olive oil for centuries.

A recent article in Olive Oil Times reported about a study carried out by Istituto Piepoli over a sample of citizens, found more and more Italians are adjusting their consumption of Extra Virgin Oils due to high prices.

According to the sample investigation, 30% of those surveyed have switched to alternative fats, 12% have reduced their consumption of Extra Virgin, and just over half said their purchasing behavior regarding Extra Virgin has remained unchanged despite the price increase.

Additionally, a Nielsen study revealed that consumption in large European retailers fell by 9.5% in 2023, with further declines of 7% and 8% in the months of January and February.

It is worth noting that non-European countries have not experienced a significant decrease in olive oil consumption.

In regions of the world, including the United States, where olive oil is not as deeply rooted in the local cuisine and alternative options are more widely available, families are willing to pay a premium for its health benefits and distinct flavour profile.

Final Thoughts

European weather forecasts predict more precipitations in April in Europe, which could be positive news for potential future market developments and for the millions of olive trees in Spain, which urgently need water after almost two years of drought.

Only the future will tell whether we are experiencing a minor market correction or the initial stage of a more extended downtrend. Despite the lower consumption in some markets, the evaluation for quality Extra Virgin Olive Oil will likely remain well above historical values for some time.

After the Easter break, when many companies in Europe observe public holidays, markets will return to respond to consistent global demand and limited inventory levels.

We still recommend that our partners and clients maintain moderate optimism and carefully plan their promotion and sales strategies on the shelf to ensure inventory availability and a quality product for the whole year until the next crop.

Back to Learn & Discover Back to Market Reports