The Market stabilizes after a hectic August and high-quality EVOO remains hard to find.

What’s happening this month?

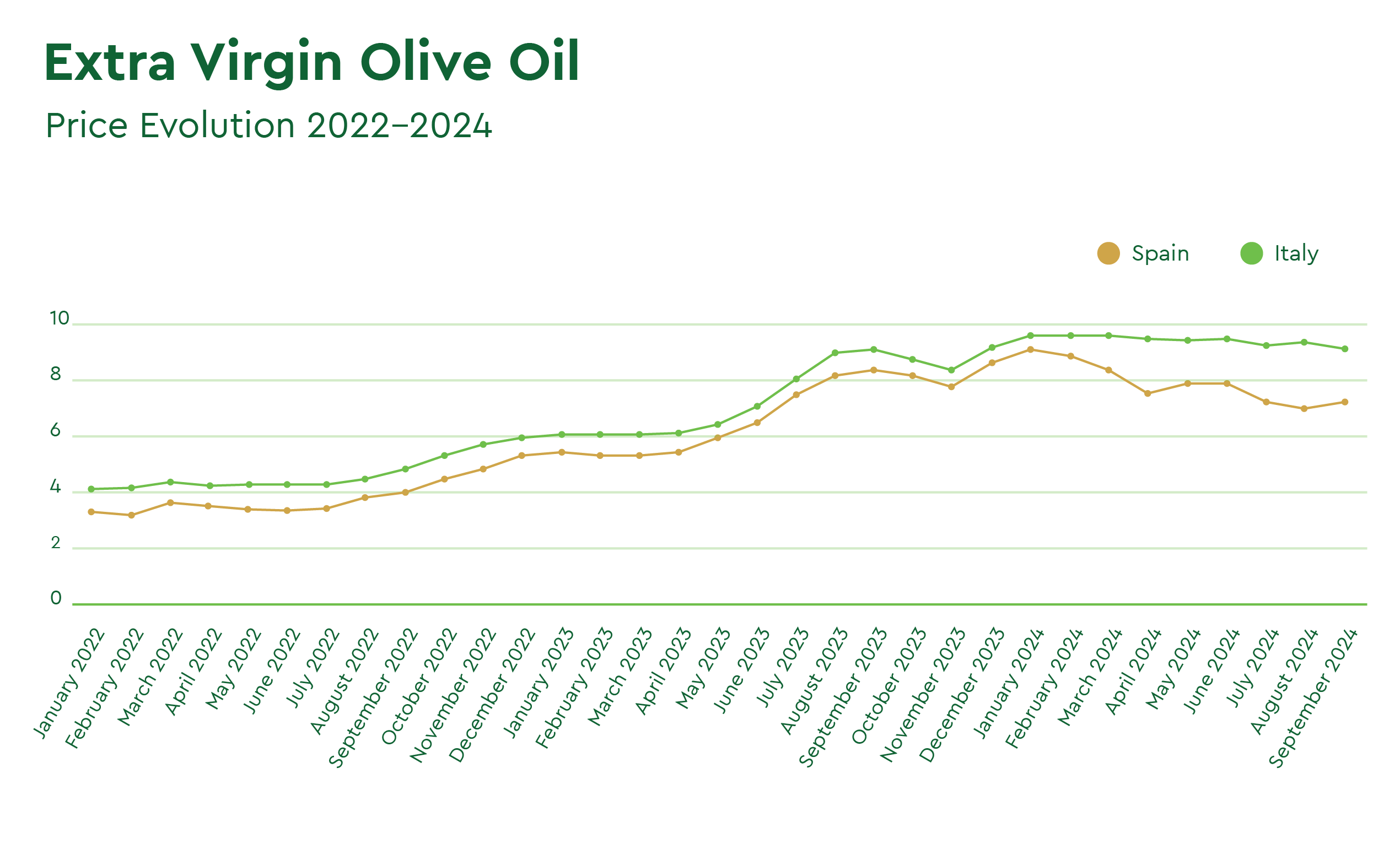

During summer, the extra virgin olive oil market is usually quiet, with many companies closing for the long holiday break and fewer transactions. However, this past month has been an exception. It started with a downward trend, led by Spain, the world’s largest producer, until mid-August, when prices began to grow again, reaching a peak in early September.

The general tension derived from the low inventory available after two consecutive years of meager global production and increasing market demand is visible on Poolred, with trades recorded at 7.20 and 7.30 Euro per kilogram in September.

As we approach the new harvest season, which typically starts between October and November in most Mediterranean areas, finding high-quality, pesticide-free extra virgin olive oil is becoming particularly challenging for sourcing managers. Traders and companies compete to secure the volumes necessary to maintain or re-build inventory required by their existing and new customers for the next few months.

Fortunately, the reopening of businesses in September and the publication of August import and export figures in Spain, released on the 11th, have triggered any significant price fluctuations.

On September 18th, Poolred and Ismea, two reliable platforms monitoring average trade value fluctuations in Spain and Italy, respectively, showed the following prices at the point of origin:

Spain: 7.22 Eu/Kg

Italy: 9.13 Eu/Kg

Greece: 7.28 Eu/Kg

Tunis: 7.53 Eu/Kg

Sources: Poolred, Ismeamercati

Moving away from averages and looking at the higher quality Extra Virgin Olive Oils category specifically, for the rest of the month, our sourcing experts expect market evaluations for Spanish conventional EVOO ranging from 7.30 Eu/Kg to 7.70 Eu/Kg, depending on quality grade and presence of pesticides.

Italian cooperatives and producers are also currently releasing the last batches of Italian EVOO from the previous harvest at peak prices of 9.25 Eu/Kg for conventional EVOO and 9.40 Eu/Kg for organic EVOO. Greek and Portuguese conventional EVOO is available at 7.60 Eu/Kg.

Spanish and Italian inventory

The market showed strong demand throughout August, as indicated by the figures released by the Spanish government in September. A total of 70,572 Tons of Olive Oil, excluding imports, were released onto the market by companies and cooperatives in the Iberian peninsula to cover domestic and export needs.

Though slightly below the average monthly figure of 75,000 Tons, the performance is still regarded as robust, underscoring the consistent growth for olive oil consumption despite the historically high prices.

Spain’s stock levels, according to August data, currently stand at 271,967 Tons, divided as follows:

Cooperatives: 138,662 Tons

Industrial Packers: 131,741 Tons

Private Storage: 1,564 Tons

Spain sold 1,052,000 Tons between July 2023 and August 2024, with expectations for an overall 5% year-on-year increase once the September figures are available. Estimates indicate that Spain will enter the 2024/25 harvest cycle with just under 200,000 Tons of stock, marking the smallest inventory in Spain’s history.

Conversely, Italy faces an even more challenging situation, as separate regional sources indicate the country will start the new harvest with zero stock, explaining the sustained high prices in the Italian market across the whole of 2024.

Increasing interest from the USA for Spanish Olive Oil

An article from Olimerca, a Spanish magazine, highlighted a growing demand for Spanish olive oil in the U.S. market. From January to June 2024, the average import value for Spanish olive oil was 8.81 Eu/Kg, compared to 8.62 Eu/Kg for Italian oil. Spain exported 93,410 Tons to the U.S. during this period—22% more than Italy and 11% more than the previous year.

Projections suggest that U.S. imports could surpass 400,000 Tons in the coming years, potentially making the U.S. the largest olive oil consumer, followed by Spain and Italy.

Final thoughts

The market is currently stable, with some remaining uncertainty as we await the availability of new volumes. Spain and Portugal are expected to start harvesting in early October. Italian and Tunisian producers are gearing up to start milling and olive oil production slightly later, by mid/end of October.

Prices are anticipated to decline across the Mediterranean region with the arrival of the new harvest, which is projected to align with historical averages. Still, the extent of this decrease remains uncertain, given the low inventory and the possibility of unforeseen events.

Our team of experts confirms that rainfall will play a critical role in determining price trends in Spain and, consequently, the rest of the market. If the right amount of rain arrives in the Mediterranean by October, average prices for Extra Virgin Olive Oil in Spain could drop to 5.50 Eu/Kg by December, creating a snowball effect in other producing countries. In the absence of rain or with extreme weather events damaging crops in some areas, average prices may stabilize closer to 6.50 Eu/Kg or higher.

By November, with the release of the first harvest data and reliable yield projections, we will have access to a more accurate idea of trends across all countries and evaluations for specific quality grades and production regions.

Back to Learn & Discover Back to Market Reports